In 1977, Schwab began offering seminars to clients.

A Charles Schwab location in Princeton, New Jersey In 1988, however, the company was forced to rebate $2 million to customers whose funds had been illegally used. Tensions between the Schwab unit and Bank of America escalated until 1987, when the deal was cut for Schwab to buy back the brokerage company for $230 million. The SEC investigated Schwab on the possibility he was selling stock to take advantage of insider information he denied it, and no charges were filed. Bank of America, however, had its own separate severe problems, and its stock plunged. Expansion was rapid, reaching 1.6 million customers in 1986, with sales of $308 million. At this point the unit had annual sales of $41 million, 600 employees, and 220,000 customers through 40 branches. He sold, but remained as president of a semi-autonomous unit. In 1981, Bank of America offered Schwab $53 million in stock for his 37 percent ownership. It expanded across the state and cut its expenses by putting a heavy emphasis on automation. In September 1975, Schwab opened its first branch in Sacramento, California. Established firms were outraged by these innovations, and tried to block Schwab's expansion.

It set up a toll-free number to take orders nationwide and later set up 24/7 telephone system that would allow customers to place orders from anywhere, at any time. Second, salesmen were (and still are today) paid hourly salaries, rather than commissions on the total sale price. First, charges to consumers were cut in half.

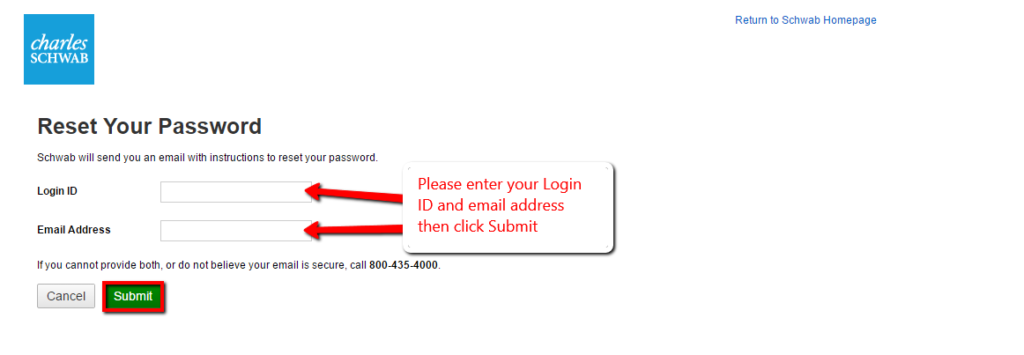

#Charles schwab login down series

Schwab set up a series of radically different policies. In those times securities were not bought by consumers, they were sold by salesmen, who made higher commissions and profits by selling riskier securities regardless of possible disadvantages to the consumers. Schwab had long complained that the established firms showed little concern for the needs of their customers. Securities and Exchange Commission deregulated the securities industry through the Securities Acts Amendments of 1975, allowing companies like Schwab to charge any fees they wanted. A decisive turning point came in 1975, when the U.S. In 1973, First Commander changed its name to Charles Schwab & Co., Inc. In 1972, Schwab himself bought all the stock from what was once Commander Industries. In November of that year, Schwab and four others purchased all the stock from Commander Industries, Inc. In April 1971, the firm incorporated in California as First Commander Corporation, a wholly owned subsidiary of Commander Industries, Inc., to offer traditional brokerage services and publish the Schwab investment newsletter. At its height, the newsletter had 3,000 subscribers, each paying $84 a year to subscribe. In 1963, Schwab and three other partners launched Investment Indicator, an investment newsletter. He is a knight of the Sigma Nu fraternity.

In 1961, he graduated from Stanford Graduate School of Business with a Master of Business Administration. Schwab graduated from Stanford University in 1959 with a Bachelor of Arts in Economics. He attended pre-college school at Holy Rosary Academy in Woodland, California. He attended Santa Barbara High School in Santa Barbara, California, and was captain of the golf team. Schwab was born in Sacramento, California, the son of Terrie and Lloyd Schwab. Īs of May 2021, his net worth is estimated by Forbes to be $10.6 billion, making him the 210th richest man in the world. He semi-retired from the company in 2008 when he stepped down as CEO, but he remains chairman and is the largest shareholder to this day. His company became by far the largest discount securities dealer in the United States. He pioneered discount sales of equity securities starting in 1975. He is the founder and chairman of the Charles Schwab Corporation. (born July 29, 1937) is an American investor and financial executive. Founder, chairman, and former CEO of Charles Schwab CorporationĬharles Robert Schwab Sr.

0 kommentar(er)

0 kommentar(er)